Since it’s easy for travel expenses to get out of hand, it’s important for us to know how much we’re spending so we can make sure we’re keeping within our planned travel budget.

When I was a kid, I remember my mom keeping track of the family’s travel spending with a little spiral notebook and pen. While that worked, it’s not the most efficient way to do this task in the 21st century.

Quite frankly, I don’t carry a pen and paper with me, and I’m a money geek who likes to see where every dime is spent. And as much as I like spreadsheets, I wouldn’t enjoy taking all those amounts and manually entering them into Excel to get this information.

If only there was a way to have everything tracked automatically and presented to us in exact amounts with beautiful graphs and charts… oh wait there is.

Seeking the Perfect Solution to Track Travel Expenses

Just five years ago, sites like Yodlee and Mint were as good as it got for online account aggregation. ‘Aggregation’ means that these sites can log into all of your online financial accounts (bank accounts, credit cards, investment accounts) and pull the important data out of them. This data is then combined and presented to you with just one login.

Mint was definitely the most popular at the time, and it still does a decent job of tracking your expenses and keeping you on budget. What it didn’t do well was the tracking of your investments and overall net worth. Because of this shortfall, Yodlee was my aggregator of choice.

I used Yodlee for many years as it could present all of your information in a fairly clean fashion, including investment accounts, credit cards, and bank accounts. Then a few years ago, they started having issues linking my accounts and I was getting double entries that were throwing all of the totals off and causing inaccuracies. Frustrated, I looked for something that could provide the information I was getting with Yodlee but without the errors.

Enter Personal Capital

I have been using Personal Capital to track travel expenses for the past two years. It works flawlessly and does everything I want it to do within a beautiful interface. You can access it on your favorite web browser, and they also have apps for your Android and Apple devices. It’s also absolutely FREE. While you’re signing up for your free account with Personal Capital and downloading the app onto your devices, I’ll show you what makes them so great for tracking your travel expenses and more.

Tracking your Travel Expenses (and Everything Else)

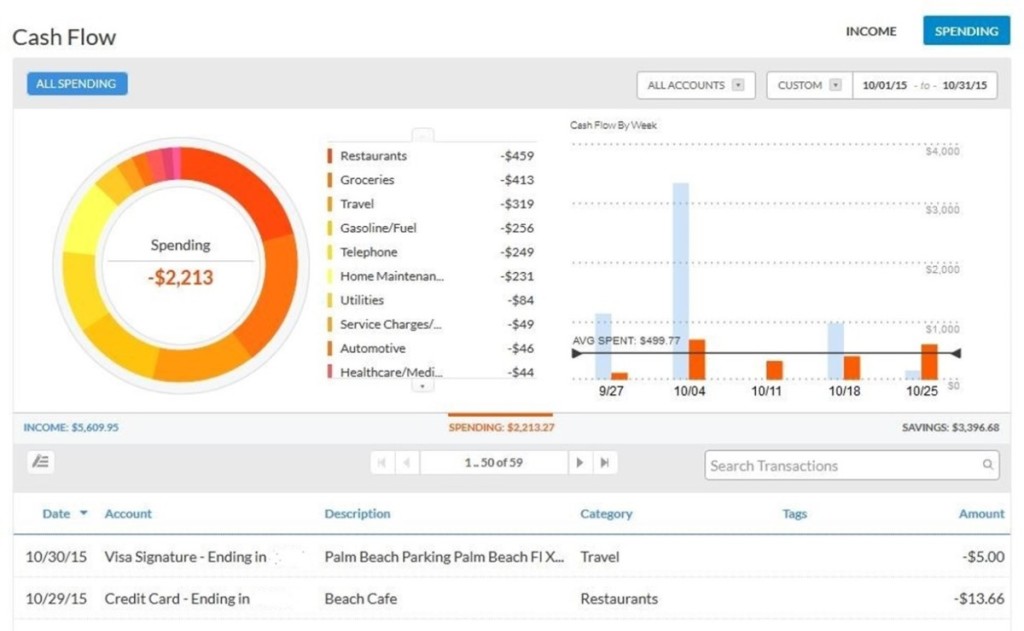

Personal Capital sees every dollar you spend, whether it’s withdrawn from your bank account, spent on your credit card, or pulled from an ATM. This means that you don’t have to enter anything manually. It also automatically categorizes each of these individual transactions, and it does a pretty good job of getting them right. If it doesn’t categorize it the way you want though, you can re-categorize the transaction with a simple click of the mouse or tap of the screen. It also has the ability to track travel expenses within a specific date range, annually, monthly, or however, you want to see it. Personal Capital’s expense tracking is how we are able to easily track our lodging costs for our major national park summer road trip.

Tracking your Income

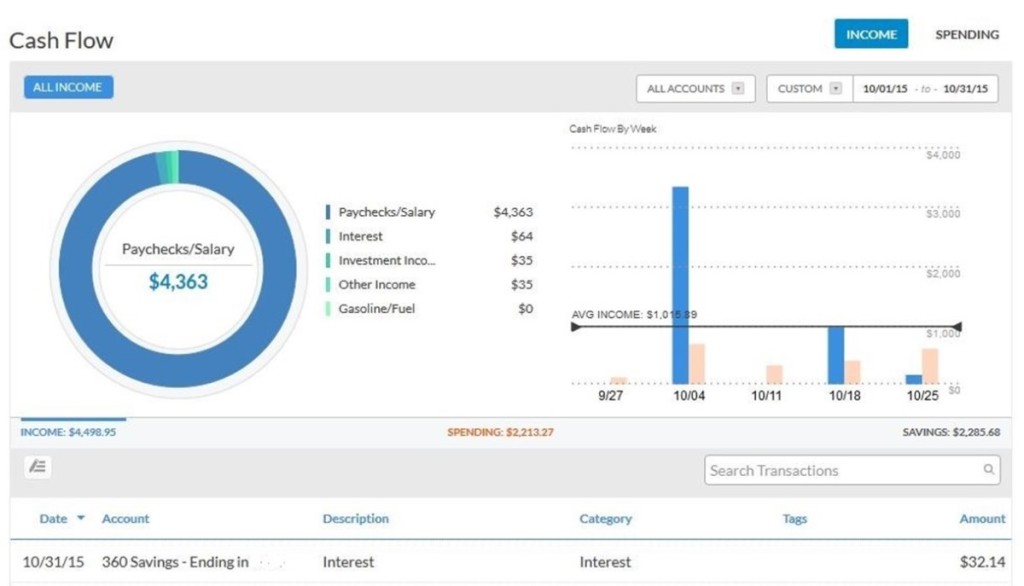

While completely automated expense tracking is awesome, Personal Capital can also track your income. Since it sees every transaction once you’ve linked your accounts, it recognizes when a paycheck is deposited into your checking account, or a dividend payment happens in your investment account. Again, all this information is completely automated after you’ve linked your accounts.

In the image above, you can see the individual transaction that helped make up the ‘interest’ portion of income. Like the expense transactions, all income transactions are automatically categorized, and the category can be changed at will with a simple click of the mouse or tap of the screen.

Investment Performance

While you could be happy with just the cash flow reporting Personal Capital provides, it also does an amazing job of tracking your investments. Not only does it track your account balances, but it also tracks your investment fees, your asset allocation, and your daily/monthly/yearly personal performance compared to the major indices. They even have a nifty retirement planner. All of this is done automatically after linking your investment accounts in Personal Capital. The information is laid out beautifully and logically, with the price being just right. FREE.

Why is this service provided for free?

Quite simply, Personal Capital would like to be your financial advisor. I have not personally utilized their financial management services since I manage my own investments (made simpler by their free app). If you’re interested in having them manage your investments, after you sign up you can schedule a free consultation with them to determine if they’re a good fit for you.

Summary

Personal Capital currently has the best account aggregator out there to track travel expenses. I appreciate the beauty and simplicity of their app and appreciate that they provide this service for free to anyone, whether you choose to utilize their management services or not. Sign up with Personal Capital now. You’ll thank me when you do.

If you are looking for more travel tips, take a look at:

- How to Survive an Airport Layover

- Reduce Hotels Expenses with Best Rate Guarantees

- What is Ebates and Why You Should Use It

- How to Travel for Free

How do you currently track travel expenses? Have you used an account aggregator before?

Like it? Pin it!

Chris Travels

Great post with helpful advise regarding the useful APP you are now using for tracking travel expenditures. Reluctantly, I guess it’s time for me to consider throwing out the spiral notebook and pen!

Dang Travelers

It is a super easy and helpful way to not only track travel expenses, but our net worth, all other expenses and investments. It gives us ease of mind regarding fraudulent activity too since it shows up to date purchases. We’ve caught a few fraudulent purchases as soon as they went through because of it.

Nancy

How many times have we gone over budget? For us probably 9 times out of 10. Personal Capital looks like it watches out for many things while you are away. I like that it catches the fraudulent purchases also, while away you just don’t think about checking your accounts for safety.

Diana

Well, I used to be financial advisor/broker so I save myself that fee lol

Claire

This is really interesting – I’ve never thought about using an app to track my travelling budget before (probably why I’m so overdrawn all the time, ha), but I’ll be considering this from now on!

Maggie

Oh this looks interesting! I never used Mint because I had smaller credit unions that it wasn’t compatible with. During my travels in South America I’ve almost entirely used cash, though, so I’m stuck using paper and pen to try to keep track. 🙂

Reni - Swiss Nomads

Hi Angela & David

Thanks for your great post. We’re just in the middle of planning of a Overlanding RTW road trip and your post comes right on time. While planning the travel expenses are one of the big issues. Doing a budget is one thing but tracking the expenses during the trip the other.

Thanks for sharing your tips.

Cheers,

Reni

Dang Travelers

Glad to help! Your trip sounds amazing!!

Bernard

Awesome! This is exactly what I need! I wanted to find a friendly app for me to track my expenses.

Dang Travelers

It’ll do a great job tracking your expenses, and can do so much more! Cash flow, investment performance, net worth tracking.. it even has a retirement planner that is simple to use (the retirement planner is only accessible when logging in via a computer). I can’t recommend them enough. I love having so much useful and accurate information right at my fingertips.

Meg @ Meg Runs The World

This is such a timely post for me. My company is putting all its employees through a Financial Fitness class that has been extremely eye-opening and helpful in getting my finances in order. I recently started using Mint to help get a better sense of my spending, but Personal Capital looks like a great option to consider, especially for tracking specific moments in time like trips or events.

Dang Travelers

We prefer Personal Capital, as it does everything Mint does (without pushing credit cards etc) AND can track your net worth/investment account performance (by aggregating investment accounts such as Vanguard, etc). It really is the best financial management app out there. Give it a try and see for yourself!

Lisa

Great tips, nothing more frustrating sometimes than the money part of any trip. I track mine too on longer trips and with app will be even easier. Happy travels!

Theresa

Too bad I’m not a money geek or I’d totally get into this. I’m still into the old school method of excel spreadsheets. Lol. However, thank you for sharing. Gives me something to think about.